clean energy fuels(纳斯达克:CLNE)股东在过去一周内上涨了11%,但在过去三年仍然亏损。

This week we saw the Clean Energy Fuels Corp. (NASDAQ:CLNE) share price climb by 11%. But over the last three years we've seen a quite serious decline. In that time, the share price dropped 63%. So the improvement may be a real relief to some. The rise has some hopeful, but turnarounds are often precarious.

While the stock has risen 11% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

Given that Clean Energy Fuels didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years, Clean Energy Fuels saw its revenue grow by 20% per year, compound. That's well above most other pre-profit companies. The share price has moved in quite the opposite direction, down 18% over that time, a bad result. It seems likely that the market is worried about the continual losses. But a share price drop of that magnitude could well signal that the market is overly negative on the stock.

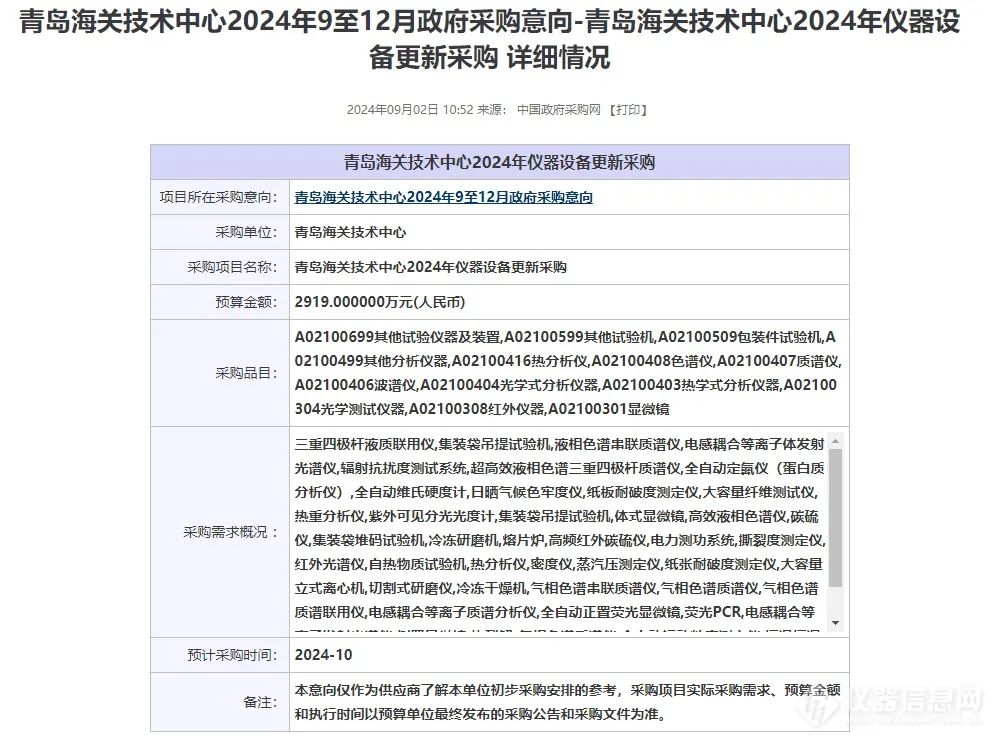

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

NasdaqGS:CLNE Earnings and Revenue Growth September 14th 2024

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. You can see what analysts are predicting for Clean Energy Fuels in this interactive graph of future profit estimates.

A Different Perspective

Investors in Clean Energy Fuels had a tough year, with a total loss of 32%, against a market gain of about 26%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 7% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Clean Energy Fuels better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Clean Energy Fuels you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

海量资讯、精准解读,尽在新浪财经APP